In Pakistan’s capital market, two types of stocks dominate every serious investor’s long-term portfolio strategy: blue-chip stocks and dividend kings.

At first glance, both sound stable, strong, and ideal for building wealth. But when it comes to choosing one for long-term investment, which is the better fit?

This article explores the key differences between blue-chip stocks and dividend kings in the context of the Pakistan Stock Exchange (PSX), helping you decide how to align your investment style with your financial goals.

What Are Blue-Chip Stocks in Pakistan?

Blue-chip stocks are shares of large, financially sound, and well-established companies that are leaders in their industries.

Common PSX examples include:

- Engro Corporation

- MCB Bank

- Lucky Cement

- HUBCO

These companies:

- Have a consistent history of profitability

- Offer better liquidity than mid/small-cap stocks

- Are widely tracked by analysts and institutional investors

They form the backbone of most KSE-100 index portfolios and are often favored for their long-term growth prospects.

What Are Dividend Kings in PSX?

Dividend kings are companies that consistently pay out dividends over a long period—often a decade or more.

While Pakistan does not officially classify “dividend kings” like the US markets, examples of local high-yield dividend stocks include:

- Fauji Fertilizer Company (FFC)

- Hub Power Company (HUBCO)

- Mari Petroleum

- Meezan Bank

These companies prioritize distributing profits to shareholders rather than reinvesting heavily for growth. As such, they are often:

- Less volatile

- More income-focused

- Seen as defensive during market downturns

Blue-Chips vs Dividend Kings: Key Differences

| Factor | Blue-Chip Stocks | Dividend Kings |

| Investment Focus | Capital appreciation | Consistent income |

| Dividend Yield | Moderate (1–3%) | High (4–8% or more) |

| Ideal Investor Type | Growth-oriented, long-term focused | Conservative, income-seeking |

| Market Sensitivity | Moderate to high | Lower, more stable |

| Portfolio Role | Core growth holdings | Income generation, stability |

| Examples (PSX) | LUCK, MCB, ENGRO | FFC, HUBCO, MARI, MEBL |

Long-Term Investment Strategy: Which Is Better?

The answer depends on your investment objective.

Choose Blue-Chip Stocks If:

- You are focused on growing your capital over a 5–10+ year horizon

- You are comfortable with moderate volatility

- You want to build wealth through price appreciation

Choose Dividend Kings If:

- You want passive income from your portfolio

- You prefer stability and lower downside risk

- You plan to reinvest dividends for compounding

Hybrid Strategy: Many investors blend both, creating a balanced portfolio that grows while generating income. For instance, allocating 60% to blue-chips and 40% to dividend stocks is a common structure.

Also read: PSX Portfolio Building Guide

Performance Comparison in PSX

Over the last decade, Pakistan’s blue-chip stocks like Lucky Cement and Systems Ltd. have delivered significant capital gains, while dividend payers like FFC and HUBCO have maintained steady income yields.

Let’s compare the long-term potential:

| Type | Capital Growth | Dividend Yield | Risk Profile | Liquidity |

| Blue-Chip Stocks | High | Low–Moderate | Medium | High |

| Dividend Kings | Moderate | High | Low | Moderate |

Risks of Each Strategy

Blue-Chip Stock Risks:

- Can be overvalued in bull markets

- Growth may slow down in recessions

- Sensitive to macroeconomic shifts

Dividend Stock Risks:

- High payout ratios may be unsustainable

- Companies may reduce dividends in tough years

- Lower capital appreciation potential

Tip: Always check financial ratios like dividend payout ratio, return on equity (ROE), and debt levels before committing to a long-term position.

Tools to Monitor These Stocks

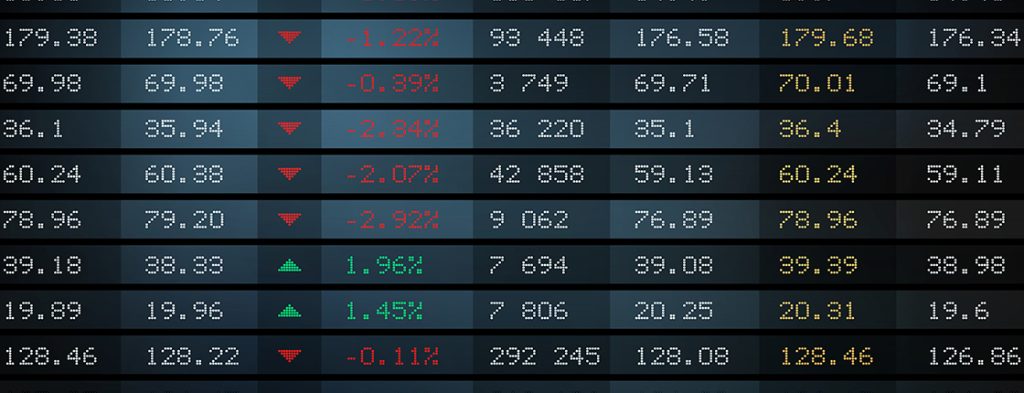

- PSX Website: Check dividend histories and company updates

- Brokerage Platforms: Real-time price and yield trackers

- Floret Capital Research Reports: Sector analysis, dividend alerts, and stock screeners

You can also use tools like:

- Dividend yield calculators

- Fundamental screeners for blue-chip filters

- Portfolio tracking dashboards

Which Stocks Dominate in Tough Times?

During down markets (e.g., political uncertainty or currency devaluation), dividend kings often outperform in relative terms due to:

- Defensive sectors (like utilities, energy, fertilizer)

- Steady cash flows

- Loyal investor base seeking income

Blue-chips tend to recover faster in bull runs but may suffer deeper during crashes unless they’re in defensive sectors.

Conclusion: Align Strategy with Life Stage

- Young Investors (Age 20–35): Focus on blue-chips for long-term capital growth.

- Middle-Aged Investors (Age 35–50): Balance both for growth + income.

- Retirees or Risk-Averse Investors: Favor dividend kings for steady returns.

The ideal long-term strategy in PSX is to diversify across both styles and adjust allocations as your financial goals evolve.